Asset allocation formula

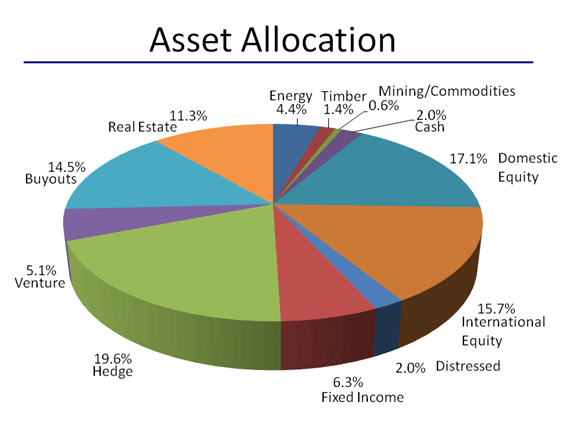

Asset allocation is the implementation of an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according. Allocation A.

Portfolio Rebalancing During Goal Based Investing Why When And How Arthgyaan

Crafted by Experts and Designed to Capitalize on Ever-Changing Markets.

. As a security moves closer to a level of support the. Financial assets that can be traded. Ad Explore Alternative Investments With Insights and Guidance From the Private Bank Team.

Our baseline or static allocation to assets in our universe. Ad Six Risk-Based Portfolios to Target a Range of Return and Risk Objectives. Lets look at some examples of asset allocation models by age.

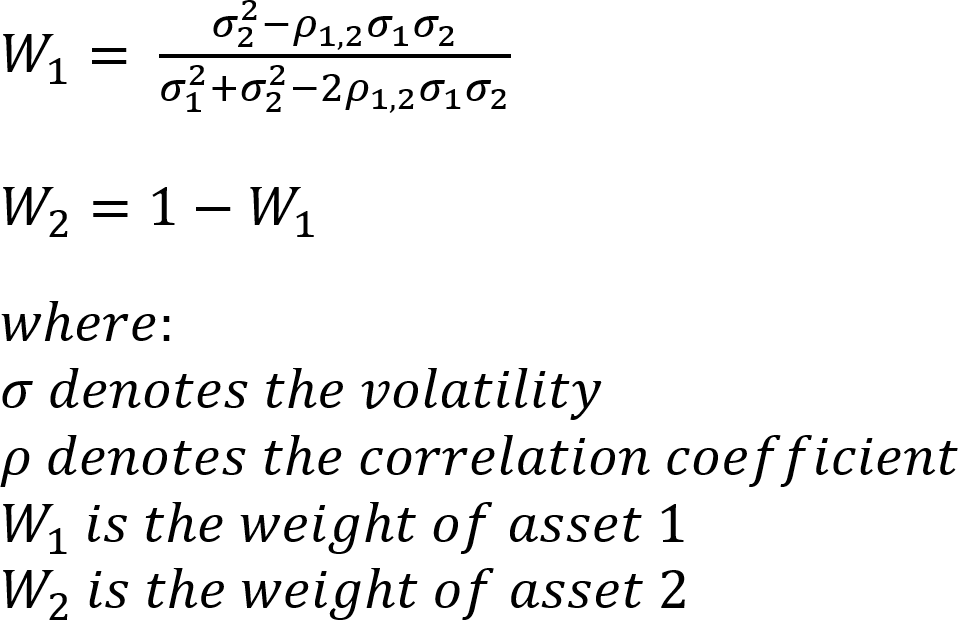

This is because the asset allocation in this type of portfolio is typically fairly well balanced between stocks and fixed income and cash. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Following asset allocation formula.

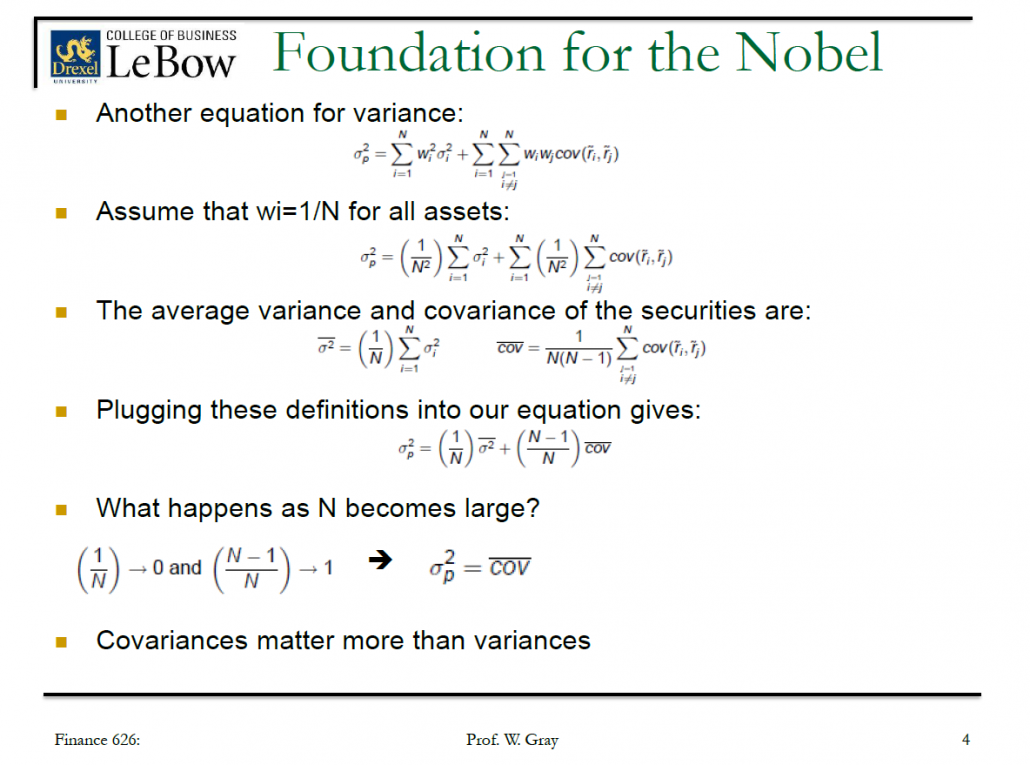

Performance attribution or investment performance attribution is a set of techniques that performance analysts use to explain why a portfolios performance differed from the. The portfolio is rebalanced. Using age minus 20 for bond allocation a starting age of 20 and a retirement age of 60 a one-size-fits-most.

This portfolio might have an allocation in. The common rule of asset allocation by age is that you should hold a percentage of stocks that is equal to 100 minus your age. Find a Dedicated Financial Advisor Now.

Age-based asset allocation is the simpler of the two techniques of strategic allocation. The security selection return results from deviations from benchmark weights. Ad Learn How Vanguard Tools For Advisors Can Help You Forecast Client Portfolio Performance.

So if youre 40 you should hold 60 of your. To make asset allocation work for you it is imperative that you consider your own specific circumstances to arrive at a customised asset allocation strategy. Eg 50 stocks 50 bonds rebalanced annually.

Our Tools Provide Reliable Unbiased Data To Help You Analyze And Optimize Portfolios. The closing out of a profitable short position as the security moves toward a key level of support. Ad Explore Alternative Investments With Insights and Guidance From the Private Bank Team.

Negative allocation effect indicates that the asset allocation decisions over the past 12 months whatever they were had a negative impact on the total portfolio performance. To make your allocation decisions easier financial professionals have devised some standard formulas for dividing up your portfolio based on. Strategic asset allocation is a portfolio strategy that involves setting target allocations for various asset classes and rebalancing periodically.

In the age-based asset allocation technique the investment decision is. Contact us to learn more about our Model Portfolio Program. The asset allocation return is the result of deviations from the asset class portfolio weights of the benchmark.

Ad Do Your Investments Align with Your Goals. Ad Explore our Model Portfolio Program access institutional-quality investment management. Cover On Approach.

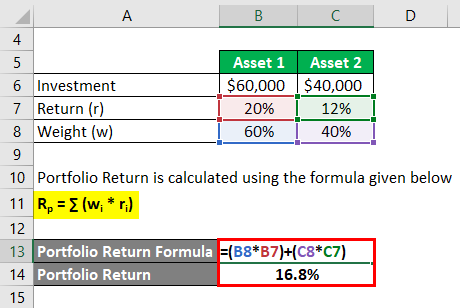

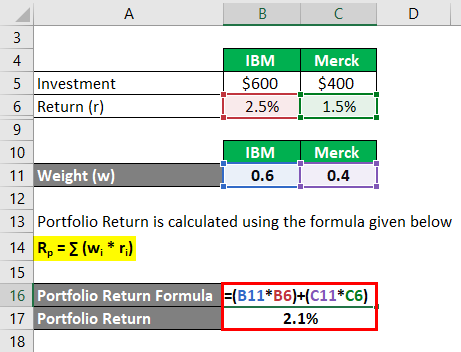

Portfolio Return Formula Calculator Examples With Excel Template

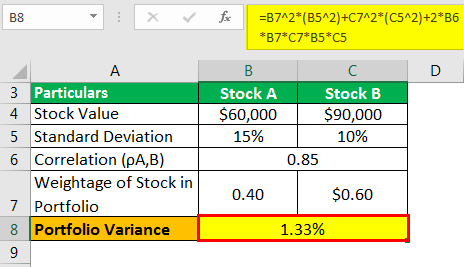

Standard Deviation And Variance Of A Portfolio Finance Train

Portfolio Return Formula Calculator Examples With Excel Template

Asset Management Lecture 15 Outline For Today Performance Attribution Ppt Download

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Lower Risk By Rethinking Asset Allocation Seeking Alpha

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

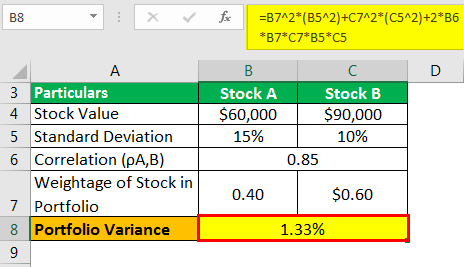

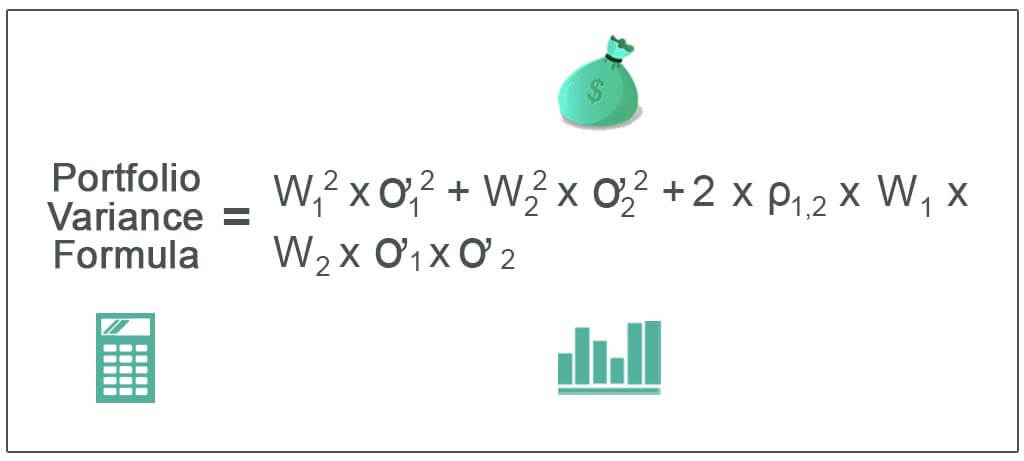

Portfolio Variance Formula Example How To Calculate Portfolio Variance

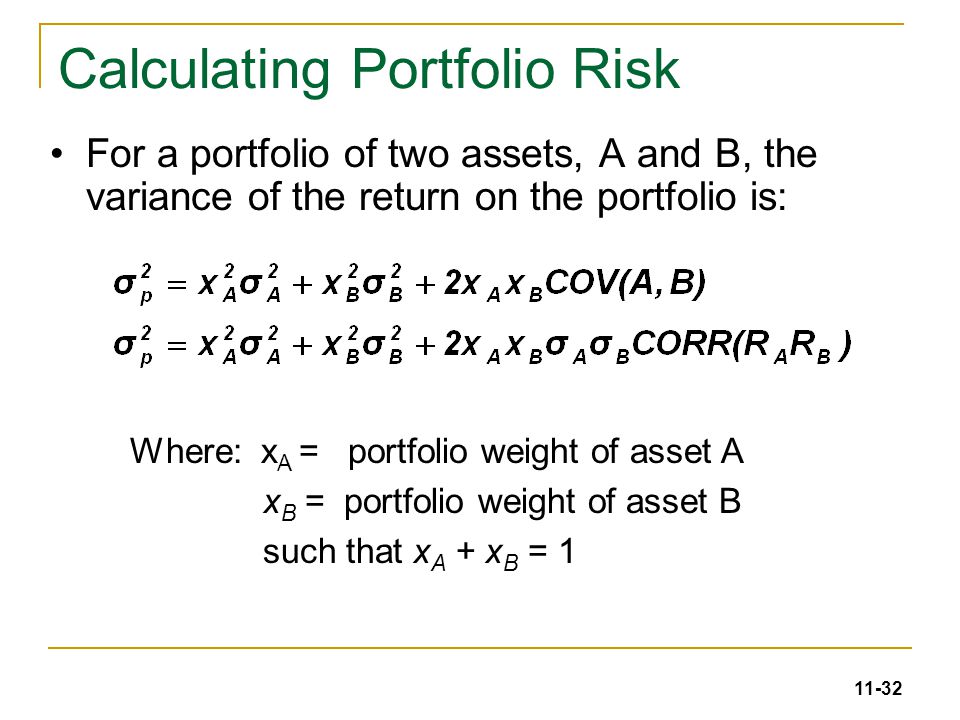

Chapter 5 Risk And Rates Of Return N

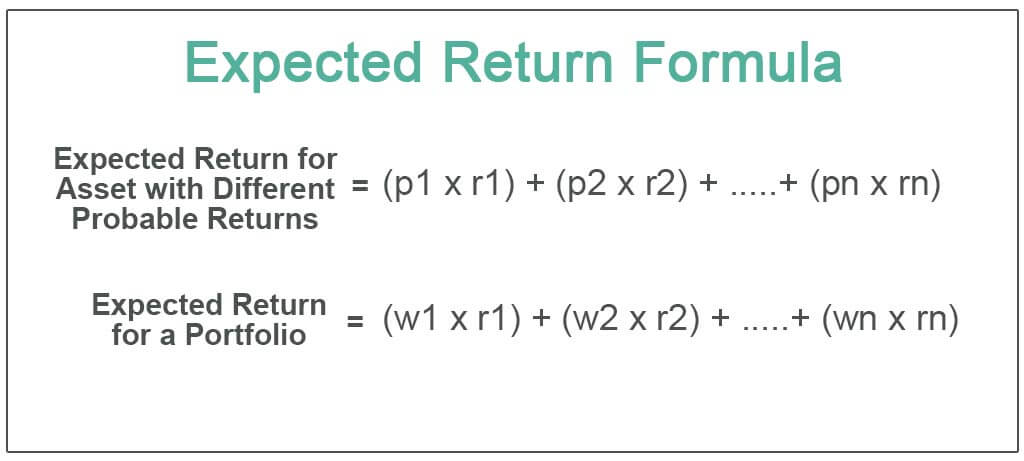

Expected Return Formula Calculate Portfolio Expected Return Example

Portfolio Variance Formula Example How To Calculate Portfolio Variance

Diversification And Risky Asset Allocation Ppt Video Online Download

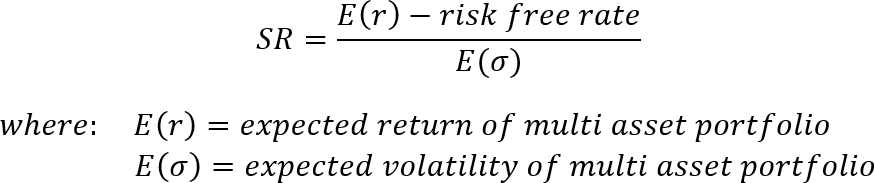

Optimization Formula For Optimal Portfolio Of 2 Assets When No Shorting Allowed Quantitative Finance Stack Exchange

Portfolio Return Formula Calculator Examples With Excel Template

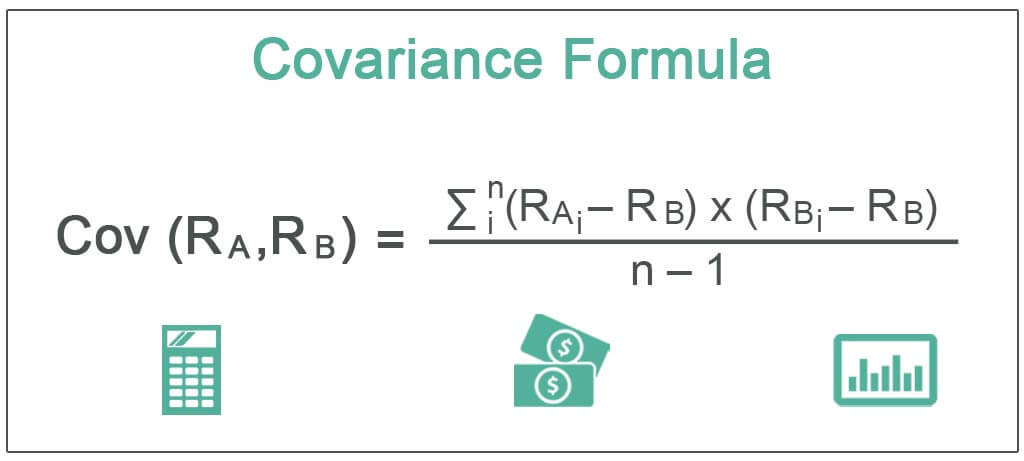

Covariance Meaning Formula How To Calculate

Solactive Diversification The Power Of Bonds

Solactive Diversification The Power Of Bonds